How to Write a Check: Step-by-Step Guide with Example

Learn how to properly fill out a check with our easy-to-follow guide. Complete with visual examples and a free interactive template.

Step-by-Step Guide to Writing a Check

Date the check

Write the current date in the top right corner. Format it as MM/DD/YYYY (e.g., 04/25/2025). You can also write out the date (e.g., April 25, 2025).

Write the recipient's name

On the "Pay to the Order of" line, write the full name of the person or company you're paying. Make sure to use the correct spelling and include any business designations (Inc., LLC, etc.).

Write the payment amount in numbers

In the small box on the right, write the amount using numbers. Start writing close to the dollar sign to prevent alterations. Include cents even if it's a whole dollar amount (e.g., $100.00).

Write the payment amount in words

On the line below the recipient's name, write out the dollar amount in words. For cents, write them as a fraction over 100 (e.g., "One hundred and 00/100"). Draw a line through any unused space to prevent alterations.

Add a memo (optional)

In the memo line on the bottom left, note the purpose of the check. This could be an account number, invoice number, or simply what the payment is for.

Sign the check

Sign your name on the line in the bottom right corner. Use the same signature that's on file with your bank. A check is not valid without your signature.

Record the check in your register

Keep track of the check in your checkbook register or banking app. Note the check number, date, recipient, and amount to help balance your account later.

Important Tips

- Always use blue or black ink when writing checks

- Write clearly and legibly to avoid confusion

- Never sign a blank check

- Keep your checkbook in a secure location

- Regularly monitor your account for cleared checks

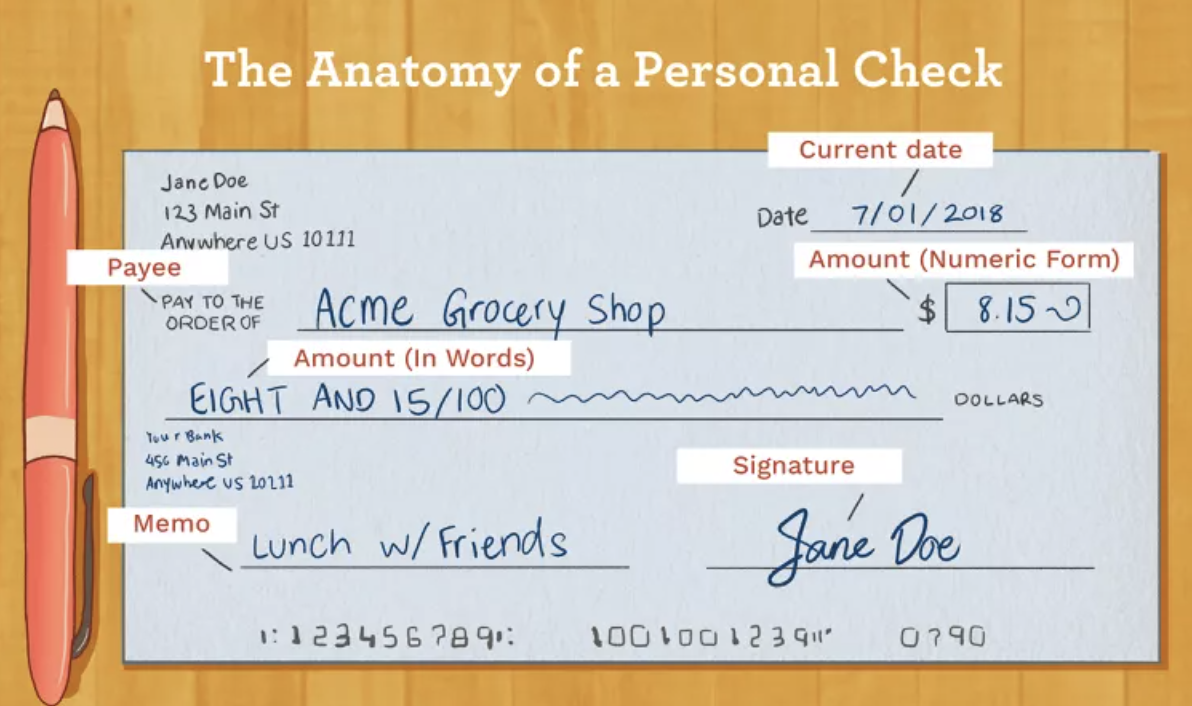

Example of a Properly Filled Check

This diagram shows the anatomy of a properly completed check with all key elements labeled. Notice how each field is filled out clearly and correctly.

Interactive Check Writer

Fill out the form below to see how your check should look. This interactive tool will help you practice writing checks correctly.

Enter Check Details

Check Preview

This is a preview of how your check should look when properly filled out.

Need a simple printable check?

Get a ready-to-use printable or editable check template for just $1.

Need a simple printable check?

Get a ready-to-use printable or editable check template for just $1.

- High-quality printable PDF

- Editable version for digital completion

- Instant download - no login required

Want the complete check writing kit?

Get the full toolkit with:

- Printable and editable checks

- Step-by-step visual guide

- VOID check sample

- Check register spreadsheet

- All for just $6.99!

Why Learn to Write Checks?

Even in today's digital world, knowing how to write a check properly remains an essential financial skill. Checks are still commonly used for rent payments, small business transactions, gifts, and situations where electronic payments aren't accepted.

Our guide and templates ensure you'll always be prepared when you need to write a check, helping you avoid errors that could lead to payment issues or even fraud.

Common Mistakes When Writing a Check

Writing a check may seem simple, but many people make small mistakes that can lead to problems or even cause the check to be rejected. Here are the most common issues to avoid:

Leaving blank spaces

Always draw a line after the written amount to prevent unauthorized edits. Blank spaces can be used to alter the check amount or add additional text.

Incorrect cents format

Use the "xx/100" format for cents (e.g., 56/100), not decimals or full words. Writing "and fifty-six cents" instead of "and 56/100" can cause confusion.

Forgetting to sign the check

Unsigned checks are invalid. Don't forget to sign it in the bottom-right corner. Banks will reject checks without a valid signature that matches their records.

Using pencil or erasable ink

Always use blue or black permanent ink to prevent alterations. Pencil or erasable ink makes it easy for someone to change the check details after you've written it.

Post-dating the check

Writing a future date can result in the check being declined or delayed by the bank. Many people don't realize that banks can choose to process a check regardless of the date written on it. If you need to delay payment, discuss alternatives with the recipient.

Frequently Asked Questions

Explore More Guides

How to Write a Check with Cents

Step-by-step guide for writing checks that include cents.

How to Write a Check for $1,000

Instructions and visual example for $1,000 checks.

How to Write a Check with Thousands and Cents

Learn to write large checks with cents correctly.

How to Void a Check

When and how to void a check for deposits or payments.

Sample: How to Write a Check

See a real filled-out check example and learn with a practical case.